What is a Native American?

The Newest Indians

On a crisp morning in March at the Jaycee Fairgrounds near Jasper, Ala., the powwow was stirring. Amid pickups with bumper stickers reading ''Native Pride'' and ''The earth does not belong to us. We belong to the earth,'' small groups gathered to check out the booths selling Indian rugs, dancing sticks, homemade knives and genealogy books. On one side, under her camper's tarp, sat Wynona Morgan, a middle-aged woman wearing a modestly embroidered Indian smock and some jewelry. Morgan had only recently discovered her Indian heritage, but, she said, in some ways she had known who she was for years. ''My grandmother always told me that she came from Indians,'' Morgan told me. She is now a member of one of the groups meeting here in Jasper, the Cherokee Tribe of Northeast Alabama, which itself is new, having organized under that name in 1997. The tribe is committed to telling its story, in part through an R.V. campground named Cedar Winds that will eventually expand to include an ''authentic, working Cherokee Indian Village.''

''The only real proof we had that we were Indian was this stub,'' Morgan went on to say. She had brought along a copy of a century-old receipt entitling an ancestor to receive some money from the United States government for being an Indian. With the help of an amateur genealogist named Bryan Hickman, Morgan was able to connect her line to its Indian roots, and she began to raise her son, Jo-Jo, as a Native American. She was particularly proud of Jo-Jo; only a teenager, Jo-Jo had been chosen to serve as honorary headman and lead the grand entry just after the grass dancers performed later that afternoon.

''Sometimes Jo-Jo gets teased for being an Indian at school, but he doesn't care,'' Morgan said. What she didn't say was that the teasing is connected to the fact that neither she nor Jo-Jo look as much like Indians as they do regular Alabama white folks. In fact, every Indian at the powwow looked white. More than half my time with this tribe was spent dealing with their anxiety that I might make this observation.

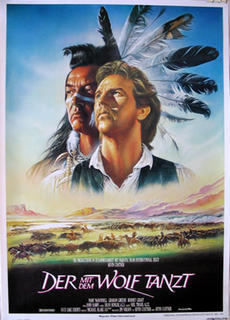

This ethnic apprehension can be found even among the older tribes, where outmarriage, or exogamy, has created a contemporary population that doesn't look nearly as ''Indian'' as the characters of our movies and HBO westerns. What results from this can get funky. For example, among coastal Indian tribes, who depend upon tourism, it is not uncommon to see them dressed as Plains Indians with full feathered headdresses and other outfits that were never their custom. It is a practice known as ''chiefing,'' and in some tribes it is as regulated as jewelry sales. This is the market force, ethnic-wise: coastal Indians know that they have to look like an outsider's vision of an Indian in order to be accepted by tourists as Indian.

Among the newer tribes, this anxiety can get especially intense. All weekend at the Jaycee Fairgrounds, the Cherokees of Northeast Alabama whom I spoke to were quite nervous that I might pronounce them, as some put it, ''ethnic frauds.'' Hickman, the genealogist, insisted upon knowing if I was ''going to make fun of them.'' In the days leading up to the powwow, he called me repeatedly, his voice filled with panic. Hardly an hour went by over the weekend that the event's spokeswoman, Karen Cooper, didn't sidle up to ask me if there was anything she could do.

Morgan, though, was happy to talk about her relatively new status as an American Indian. She had been attending powwows for years as a white woman, but became official two years ago after her genealogical work was done. ''I hate to put it this way, but I'm a completely new Indian,'' she said. ''I have had to learn everything from the ground up, and I'm learning every day.''

Morgan's sincerity and her profound pleasure at all these discoveries in her ancestral line now influences every waking moment of her life, she said. She confided that she knows that there are fake Indians -- so-called wannabes -- and she says she feels sorry for them. ''I hear some people say that they have a 'Cherokee princess' up the line,'' Morgan said with a laugh. ''I just love that one, because of course the Cherokees didn't have a princess.'' This joke -- about the white person claiming a Cherokee princess -- is heard pretty often these days from any Indian, coast to coast. In the same way that blacks poke fun at white men who can't jump or Jews mock goyim mispronunciations of Yiddish words, it is not meant as much to put down others as to enunciate the authenticity and insider status of the person telling the joke. It is a way to assuage a new kind of ethnic unease that can be felt throughout Indian Country.

The Cherokee Tribe of Northeast Alabama is, according to the University of Oklahoma anthropologist Circe Sturm, one of more than 65 state-recognized tribes, most of which have emerged in the last few decades in the Southeast. State recognition is merely one of many legal mechanisms used to legitimate a Native American tribe. They range from the most difficult -- federal recognition, which is required for running a casino -- to state and local designations and on to unrecognized groups. (The Cherokees alone account for more than 200 of these recently formed unaffiliated tribes.) All of these tribes have emerged at a moment when Native Americans have experienced skyrocketing growth in population. I had traveled to Jasper, among other places, to find out what kind of growing pains this population surge is causing Native Americans.

Soon enough, the shed at the fairgrounds was all commotion as the grass dance began. Jo-Jo was dressed in full regalia, and like all the dancers here, he had made his bustle and other ornaments. The grass dancers were pouring their hearts into it. The crowd was mostly other tribal members, as well as what are called ''hobbyists,'' non-Indian enthusiasts who like to attend public powwows. All of them were thrilled with the performance, and it was hard not to be impressed by the difficult moves and the elaborate costumes. I meant to keep my eye on Jo-Jo, but I was distracted by another handsome teenage boy with light brown hair, the head grass dancer, who didn't seem to have made the full transition to Indian yet. His outfit was a painstaking interplay of beads and feathers and a series of striking variations of white and red shapes sewn onto his vest, which for some reason caught my eye and seduced me into leaving the bleacher seats in order to wander closer to the rail, elbowing my way out in front of even small children to peer more carefully and to make absolutely sure that the tiny red rectangles were -- yes, indeed, no doubt about it -- little Confederate battle flags.

century ago, Native Americans were down to a few hundred thousand people, and the prevailing concern was not about overpopulation but about extinction. Some observers comfortably predicted that America would close the book on its ''vanishing race'' by 1935. But Native Americans didn't disappear, and after the birth of civil rights, when the Red Power movement asserted itself in the 1960's, something unexpected happened in the Indian population count. In four consecutive censuses, which showed other groups growing by 7 to 10 percent, Native American populations soared, growing by more than 50 percent in 1970, by more than 70 percent in 1980 and another third in 1990. The 2000 census reveals an overall doubling, to more than four million. Jack D. Forbes, an emeritus professor of Native American studies at the University of California at Davis, argues that undercounts and other census quirks may mean that the total number of Indians in the United States today is in fact closer to 15 or even 30 million. Using the 2000 census data, Indians can be called America's fastest-growing minority.

century ago, Native Americans were down to a few hundred thousand people, and the prevailing concern was not about overpopulation but about extinction. Some observers comfortably predicted that America would close the book on its ''vanishing race'' by 1935. But Native Americans didn't disappear, and after the birth of civil rights, when the Red Power movement asserted itself in the 1960's, something unexpected happened in the Indian population count. In four consecutive censuses, which showed other groups growing by 7 to 10 percent, Native American populations soared, growing by more than 50 percent in 1970, by more than 70 percent in 1980 and another third in 1990. The 2000 census reveals an overall doubling, to more than four million. Jack D. Forbes, an emeritus professor of Native American studies at the University of California at Davis, argues that undercounts and other census quirks may mean that the total number of Indians in the United States today is in fact closer to 15 or even 30 million. Using the 2000 census data, Indians can be called America's fastest-growing minority.

The assumption many people make when they hear these huge numbers is that the new Indians are just cashing in on casino money. But tribes with casinos or even casino potential have very restrictive enrollment policies. (If anything, when casinos are involved, the story usually goes heartbreakingly in the other direction. Take the case of Kathy Lewis, whose grandfather was the chief of the Chukchansi tribe, which now runs a casino with another tribe outside Fresno, Calif. Her father worked out a deal with the tribal council that placed him on the lucrative tribe's rolls but cut out his own children. He no longer speaks to his daughter. Impoverished, she lives in a two-room trailer just outside the reservation.)

Instead, the demographic spike in population is a symptom of what sociologists call ''ethnic shifting'' or ''ethnic shopping.'' This phenomenon reflects the way more and more Americans have come to feel comfortable changing out of the identities they were born into and donning new ethnicities in which they feel more at home. There is almost no group in this hemisphere immune to the dramas accompanying so much ethnic innovation. Last year in Montreal, for example, the selection of Tara Hecksher as Irish-Canadian parade queen seemed to many to be inspired. While the young woman's father is Irish, her mother is Nigerian. To look at her face and hair, most people would instinctively categorize her as ''black.'' Certainly the thug that interrupted the parade by tossing a white liquid at her seemed to think that way.

Such agonies of identity abound, but nowhere are they felt more keenly than among Native Americans. There, many of the markers of being Indian -- the personal adornments, the spiritual life, daily tribal culture -- are the subject of intense debate, in some cases even federal regulation. Much of what has defined Indianness has been appropriated by everyone from Hollywood to charlatan spiritual guides and ground into unappealing cliche. As a result, many Indians are trying to define the new modern Native American in terms that can't be so easily commodified. Some argue that this ethnic mobility in and out of Indian Country is connected to a separate phenomenon -- a rush to revitalize native languages. Many tribes have hired linguists or sent members to any of several institutes now devoted to helping Indians retain or recreate some form of their tribal languages.

n the past, ethnicity and race seemed like fixed categories, inherent qualities of self that were not only unchanging but could also be measured, quantified and reduced to small checkable boxes on bureaucratic forms. But American diversity and intermarriage (as well as the perfect match between the Internet and deep genealogical research) have changed this singular certainty into a multiple-choice question. For most of American history, identity was centrally controlled: the census taker decided your identity by quietly writing it down while asking questions at your door. But in 1960, the census was changed to permit Americans to declare their own race or ethnicity. The most significant shift, though, came as recently as the 2000 census. Americans were permitted to declare more than one race or identity. As a result, the old categories become even more fluid.

n the past, ethnicity and race seemed like fixed categories, inherent qualities of self that were not only unchanging but could also be measured, quantified and reduced to small checkable boxes on bureaucratic forms. But American diversity and intermarriage (as well as the perfect match between the Internet and deep genealogical research) have changed this singular certainty into a multiple-choice question. For most of American history, identity was centrally controlled: the census taker decided your identity by quietly writing it down while asking questions at your door. But in 1960, the census was changed to permit Americans to declare their own race or ethnicity. The most significant shift, though, came as recently as the 2000 census. Americans were permitted to declare more than one race or identity. As a result, the old categories become even more fluid.

How much easier (though scarier) life might be if we all got ethnic identification cards so that when encountering a very light-skinned person claiming to be black, you could reply, ''O.K., show me your federal identification card guaranteeing the proper amount of African blood to qualify you as an African-American.'' Here's the thing: you could ask an Indian that question. Some Native Americans carry what is called, awkwardly, a white card, officially known as a C.D.I.B., a Certificate of Degree of Indian Blood. This card certifies a Native American's ''blood quantum'' and can be issued only after a tribe has been cleared by a federal subagency.

The practice of measuring Indian blood dates to the period just after the Civil War when the American government decided to shift its genocide policy against the Indians from elimination at gunpoint to the gentler idea of breeding them out of existence. It wasn't a new plan. Regarding Indians, Thomas Jefferson wrote that ''the ultimate point of rest and happiness for them is to let our settlements and theirs meet and blend together, to intermix, and become one people.'' When this idea was pursued bureaucratically under President Ulysses S. Grant, Americans were introduced to such phrases as ''half breed'' and ''full blood'' as scientific terms. In a diabolical stroke, the government granted more rewards and privileges the less Indian you were. For instance, when reservation lands were being broken up into individual land grants, full-blooded Indians were ruled ''incompetent'' because they didn't have enough civilized blood in them and their lands were administered for them by proxy agents. On the other hand, the land was given outright to Indians who were half white or three-quarters white. Here was the long-term catch: as Indians married among whites and gained more privileges, their blood fraction would get smaller, so that in time Indians would reproduce themselves out of existence.

Compounding this federal reward for intermarriage was the generally amicable tradition most tribes had of welcoming in outsiders. From the earliest days of European settlement, whites were amicably embraced by Indian tribes. For instance, the leader of the Cherokee Nation during the forced exile of 1838-39 -- the Trail of Tears -- was John Ross, often described as being seven-eighths Scottish.

A lot of Indians haven't looked ''Indian'' for quite a while, especially in the eastern half of the country, where there is a longer history of contact with Europeans. That fact might not have been the source of much anxiety in the past, but in the post-Civil Rights era, the connotations of the word ''white'' began to shift at the same time that the cultural conversation progressed from the plight of ''Negroes'' to the civil rights of ''blacks.'' Suddenly ''white'' acquired a whiff of racism. This association may well account for the rise of more respectable ethnic descriptions like ''Irish-American'' or ''Norwegian-American,'' terms that neatly leapfrog your identity from Old World to New without any hint of the Civil War in between. According to the work of Ruth Frankenberg and other scholars, some white people associate whiteness with ''mayonnaise'' and ''paleness'' and ''spiritual emptiness.'' So whatever is happening in Indian Country is being aggravated by an unexpected ethnic pressure next door: people who could be considered white but who can legitimately (or illegitimately) find an Indian ancestor now prefer to fashion their claim of identity around a different description of self. And in a nation defined by ethnic anxiety, what greater salve is there than to become a member of the one people who have been here all along?

The reaction from lifelong Indians runs the gamut. It is easy to find Native Americans who denounce many of these new Indians as members of the wannabe tribe. But it is also easy to find Indians like Clem Iron Wing, an elder among the Sioux, who sees this flood of new ethnic claims as magnificent, a surge of Indians ''trying to come home.'' Those Indians who ridicule Iron Wing's lax sense of tribal membership have retrofitted the old genocidal system of blood quantum -- measuring racial purity by blood -- into the new standard for real Indianness, a choice rich with paradox. The Native American scholar C. Matthew Snipp has written that the relationship between Native Americans and the agency that issues the C.D.I.B. card is ''not too different than the relationship that exists for championship collies and the American Kennel Club.''

ut on Chicaugon Lake on a warm afternoon in Michigan, dozens of families splashed around in the water, having good summer fun. Inside the nearby picnic shed, a few dozen folks assembled for an Ojibwe language camp. The camp was off to an awkward start. The adults stood at uncomfortable attention. The teenagers, off to one side, smoked and lobbed withering looks everywhere. The little ones raced about, crazed that they couldn't join the children in the lake.

ut on Chicaugon Lake on a warm afternoon in Michigan, dozens of families splashed around in the water, having good summer fun. Inside the nearby picnic shed, a few dozen folks assembled for an Ojibwe language camp. The camp was off to an awkward start. The adults stood at uncomfortable attention. The teenagers, off to one side, smoked and lobbed withering looks everywhere. The little ones raced about, crazed that they couldn't join the children in the lake.

The leader was Wendy Geniusz, a young blonde whose cute cheeky smile seemed to reflect her father's Polish background (as did that killer surname). She has been raised among the Ojibwe all her life. Her mother, Mary, is the granddaughter of a Canadian Indian who gave up her native claim after marrying a Presbyterian Scot. But Mary knew this grandmother, and about 25 years ago, when she started having her children, she decided that she could no longer indulge what she saw as the luxury of her multiple backgrounds. She needed to create a coherent environment for her children.

After finding a spiritual guide to lead her back to the world of her grandmother, Mary raised her children among the Ojibwe. Wendy Geniusz was born an Indian. She is known by her birth name, Makoons, and she has attended local powwows since she can remember. Geniusz's days begin, as they have for the past five years, with a tobacco offering and prayer. She is married to an Ojibwe man, Errol Geniusz (having taken her last name), and she intends to raise her children speaking Ojibwe in her home; she mastered the language at the University of Minnesota, where her Ph.D. topic is ''Decolonization of Ojibwe Plant Knowledge.'' She teaches the language to other members of the tribe.

One of the exercises this morning was to get people to ask one another basic questions in Ojibwe. About 10 kids, all around 11 or 12, were horsing around as Geniusz struggled to guide them through the paces. It was rough going. Two kids in particular were jumping on each other. One looked classically Indian; the other was a blond. The black-haired boy teasingly referred to the other as ''whitey.'' There were a few anxious looks among the adults, yet here on the Upper Peninsula, no one corrected the black-haired boy, in part because he is the great grandson of the tribal elder who was in attendance to lend the language camp a sense of history (and to resolve the occasional grammar stumper). Later that morning, when the teasing continued, the blond kid broke into a rap from ''Scary Movie 3'': ''I'm a white boy, but my neck is red/I put Miracle Whip on my Wonder Bread.'' The anxiety that was a constant at the Alabama powwow was present here, too, but it was acknowledged not with panic but with jokes and stories.

''People usually think I'm white,'' Geniusz explained. ''Like recently, my sister and I took a bunch of clothing to an Indian rummage sale, and they thought we were just some white kids bringing clothes down.'' On the other hand, she recalled attending a recent national Indian conference at which each tribe was asked to stand up and say hello. ''I was with the Chicaguan Chippewa, and they said I should get up and say hello because I spoke more Ojibwe. So I got up and said something very simple, like 'Boozhoo giinawaa,' or 'Hello, all of you.' And afterward, I had all these people coming up and hugging me and telling me that they had thought I was just some little white girl. When I speak, people get a little startled, and then they accept me.''

Circe Sturm, whose book on new Indian tribes, ''Claiming Redness,'' is due next year, suggests that ''one big difference between older recognized tribes and the newer tribes is that the newer groups are marked by a nervous disavowal of whiteness. You will often hear them talk about their 'Indian hair' or their 'Indian cheekbones.' They often solemnly conclude their conversations by saying, 'For all purposes, I consider myself Indian.' The older tribes acknowledge their whiteness. Oklahoma Cherokees talk about 'white Cherokees' and often make a joke about it.''

Ethnicity is a tricky thing because it is commonly understood as something fixed and essential rather than what it more likely is: an unarticulated negotiation between what you call yourself and what other people are willing to call you back. Geniusz has lived her life culturally among the Ojibwe and is recognized by them as an Indian. Her easy comfort at calling herself an Indian comes in part because everyone in her area recognizes the essential Indian life she has led. Her physically European features are, in this part of Michigan at least, understood as only marginally curious.

The way the ethnic negotiation works depends on what part of the country you are located in. Native Americans recognize that there exists a kind of spectrum. At one end there are Indians living on a well-established Western reservation in a tribe that is branded as seriously authentic -- Hopi, say -- where many in the tribe retain the classic Indian physical characteristics. Moving along, you encounter various tribes that have intermarried a lot -- like the Ojibwe -- yet whose members still feel a powerful sense of authenticity. But once you visit tribes of newcomers, where few members knew their Indian ancestors personally, you begin to sense a clawing anxiety of identity. At the far end are hobbyists, those Indian groupies who hang around powwows, hoping to find a native branch in their family tree. They enjoy wearing the traditional tribal garb and are, as the University of Michigan history professor Philip Deloria titled his book, ''Playing Indian.'' Most hobbyists do it for fun, although some are just criminals, like Ronald A. Roberts, who pleaded guilty to federal charges after trying to establish a casino with his forged genealogical documents, or David Smith, who was jailed for holding a ''healing ceremony'' for a 12-year-old girl that included fondling her.

Just where in that spectrum, between land-based tribes in the West and playful hobbyists, you might locate a bright dividing line of authenticity is an open question. It is territory that is currently being remapped. It is why the population of Indians is surging and why there is such fervent debate among Indians as to just who should be able to make the claim. It becomes a kind of nature-versus-nurture argument. Do genetics make you Indian or does culture? Or can either one?

It is in the context of such continued questions that the renewed interest in language takes on more urgent meaning. According to Laura Redish, the director of a resource clearinghouse for language revival called Native Languages of the Americas, there are roughly 150 native languages that are currently spoken in North America or that have disappeared recently enough that they could still be revived. She estimates that in the last 10 years, some 80 to 90 percent of the tribes associated with these languages have put together some kind of program of revival.

''Language has a different kind of importance now than it did only 20 or 30 years ago,'' says Ofelia Zepeda, the director of the American Indian Language Development Institute in Arizona, whose program in revitalizing languages works with about 20 tribes each year. ''Language is one of those things that you take for granted, but now it has a different dimension. It is a conscious act.''

s the sun angled down over Lake Chicaugon, Wendy Geniusz's language camp magically came together. The sullen teenagers were still smoking, but like the little kids were now tuned in. Everyone gathered around separate picnic tables set for a meal, and they were calling out the names of table utensils in Ojibwe. One of Geniusz's assistants, a very handsome native speaker with a long black ponytail named James Vukelich, stood up and announced: ''If you want to learn how to pick people up in Ojibwe, come over here. If you don't know what that means, stay where you are.'' Suddenly, the teenagers were all scrambling over to Vukelich's corner. Once the teenagers had decided that talking the ancestral language was as cool a thing as mastering smoke rings, the next three days of Ojibwe Language Camp were smooth sailing.

s the sun angled down over Lake Chicaugon, Wendy Geniusz's language camp magically came together. The sullen teenagers were still smoking, but like the little kids were now tuned in. Everyone gathered around separate picnic tables set for a meal, and they were calling out the names of table utensils in Ojibwe. One of Geniusz's assistants, a very handsome native speaker with a long black ponytail named James Vukelich, stood up and announced: ''If you want to learn how to pick people up in Ojibwe, come over here. If you don't know what that means, stay where you are.'' Suddenly, the teenagers were all scrambling over to Vukelich's corner. Once the teenagers had decided that talking the ancestral language was as cool a thing as mastering smoke rings, the next three days of Ojibwe Language Camp were smooth sailing.

Geniusz is a proselytizer for language revival. She has interviewed tribal elders, put together CD-ROM's of language basics and created coloring books for kids. She attends Indian language revival conferences and exchanges tips with other tribal members, like Lone Wolf Jackson, an officer with one of the Mohegan tribes in Connecticut who is pushing his tribe to revive its language.

''I don't think we'll ever see the day when Mohegans are walking down the street speaking Mohegan to each other,'' Jackson told me when I met up with him at a conference on language revitalization. ''But I do think we can learn enough to conduct a religious service or a funeral in our own language. And that would be profoundly important.''

If you passed Jackson on the street, you would think he was black. And he is, on his father's side. But he was raised by the other side of his family, his mother and grandmother, who are Mohegan Indians.

''One of the motives behind the assimilation program was to get Indians to act like everyone else and not retain any cultural distinctiveness,'' Philip Deloria says. The revival of Indian language may be the new front in resisting total assimilation. ''For Indians to make a new argument of sovereignty, it will rely on a renewal of Indian distinctiveness.''

Laura Redish sees language revival at the heart of the new anxiety of identity: ''It also takes a commitment to learn a language. I've noticed that urban mixed bloods, especially, want to learn -- to not be wannabes. And language shows they are serious about connecting to who they are.''

From a small country lane in Connecticut, Stephanie Fielding rambled down a few dirt roads to a small clearing beside a rushing river. Her great-great-great-aunt Fidelia Fielding died in 1908, and a memorial stone dominates the sloping cemetery here. Fidelia was the last speaker of Mohegan. Today, Stephanie Fielding is devoted to reviving the language that Fidelia Fielding spoke. She travels from library to library scouring books and ancient missionary letters and documents. She is putting together her ancestral language, brick by brick, word by word.

You might mistake Stephanie Fielding for just another nice-looking lady with reddish hair and, judging from that name, British extraction. But she is a member of the wealthiest Indian tribe in America -- the Connecticut Mohegans, whose members divide the revenue from two lucrative casinos. Fielding is 59, and she has devoted the rest of her life to reviving her great-great-great-aunt's language. This June, she received her master's degree in linguistics from M.I.T. Like so many people devoted to language restoration, she admires the example of Hebrew, a language that essentially died more than two millennia ago, surviving only as a sacred text. It wasn't until the 19th century that a Zionist linguist took on the painstaking work of confecting a modern, slangy, day-to-day tongue out of the hallowed idiom of Moses. Fielding is trying to do the same, and then some. She doesn't begin with a body of Scripture, like the revivers of Hebrew had, but with not much more than some missionaries' notes and transcripts of long-dead speakers. Most of Fielding's work at M.I.T. has focused on creating a kind of linguistic algorithm that will permit her to take many of the accepted proto-Algonquian words and generate an authentic Mohegan vocabulary. Her tribe has commissioned her to put together a dictionary and a grammar to give the next generation a voice from the past.

Because it is time-consuming and difficult to learn any language, the commitment it takes to attend one of Wendy Geniusz's camps or to sign on with Fielding's work or to participate in any of the widespread Native American language revivals weeds out the easy hobbyists and leaves a cohort of Indians whose authenticity -- regardless of genealogy or blood quantum -- may one day be hard to question.

''Language is an important vehicle of transmission of culture,'' says Angela Gonzales, a Hopi Indian and an assistant professor of sociology at Cornell University. ''Some tribes resist letting any outsiders even speak their language. But that's why language is important. It's a great vehicle for the storage of important inaccessible cultural material.'' Since it is no longer enough for a man passing you on the street to look Indian, maybe the next generation will note in passing that that guy certainly sounded Indian. In 50 years, many of the tribes now being dissed as wannabes will have age, tradition and solemnity on their side. Who will be around to question their authenticity? Far more likely is the possibility that the reshaping of American identity, among Indians as well as other ethnicities, will simply be accepted as the way it always was and always was meant to be.

Kathleen Hinckley, the executive director of the Association of Professional Genealogists, explains that she constantly gets calls from people asking her to ''find an Indian'' in the family tree. But she also says that such requests were part of a much larger surge of genealogical interest. Her membership of professional genealogists has leapt from 1,000 to 1,700 in the last five years. Genealogists will tell you the phone always rings most on Monday, the day after a Sunday family reunion when some aging great-aunt finally confesses that her grandmother was a Chippewa or a Jew or from one of the noble clans of Scots, sending another anxious young American into the domains of ancestry.com or Hinckley's organization or into city-hall records to find the answer to the question What is my true past?

As an academic term, ethnic identity has long been associated with images of immigrant neighborhoods and ghettos -- dense collections of Jews or Italians, Irish or Germans who maintained the old ways, married among themselves and maybe even kept up the old language. But today's scattered, more mobile generations have less access to such stable reservoirs of ethnic identity, which may account for this rise in ethnic shopping and the need to lay claim through participation in ethnic festivals or religious conversion or powwows to an identity that better suits the itch of our increasingly intermarried, interracial, intertribal America.